There are approximately 417,730 insurance agents in the United States. The insurance industry in the US is robust and employs a large number of insurance agents across the nation.

With a diverse range of specialties, from health insurance to life insurance, these agents play a crucial role in helping individuals and businesses find the right insurance coverage for their needs. Insurance agents not only assist clients in understanding complex insurance policies but also provide guidance and support throughout the claims process.

Over the years, the insurance industry has evolved, and insurance agents have adapted to new technologies and trends to better serve their clientele. As a vital link between insurance companies and policyholders, insurance agents are fundamental in ensuring individuals and businesses are adequately protected against unforeseen events.

Insurance Agents in the USA

Table of Contents

Current Landscape Of Insurance Agents In The USA

Insurance continues to be a crucial aspect of everyday life, shaping the financial security and stability of individuals and businesses across the United States. The current landscape of insurance agents in the USA highlights the significant role played by these professionals in the insurance industry. From the population of insurance agents to the concentration of agents in different states, several factors contribute to the dynamic nature of this sector.

Population Of Insurance Agents

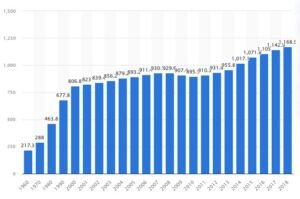

The population of insurance agents in the USA comprises a diverse and widespread community of professionals. With over one million insurance agents operating across the country, the industry reflects a significant presence in the market. This widespread presence enables individuals and businesses to access a wide range of insurance options and services, catering to their specific needs and requirements.

Concentration Of Agents In Different States

When analyzing the concentration of insurance agents in different states, certain regions showcase a higher density of professionals in comparison to others. For instance, states such as California, Texas, and Florida exhibit a high concentration of insurance agents, reflecting the varying demands for insurance services in these areas. This spatial distribution of agents contributes to the accessibility and availability of insurance offerings to the local populations.

Factors Affecting The Number of Insurance Agents

The number of insurance agents in the USA varies based on factors like market demand and industry growth. Geographic distribution and state-specific regulations also impact the total count nationwide. Factors such as demographics, competition, and economic conditions play key roles in determining the number of insurance agents operating in the country.

Several factors contribute to the number of insurance agents in the United States. These factors shape the regulatory environment and market demand for insurance products. Understanding these key factors can provide valuable insights into the industry’s growth and development.

Regulatory Environment

The regulatory environment plays a crucial role in determining the number of insurance agents in the USA. Each state has its own set of regulations governing insurance licensing and agent qualifications. These regulations establish the criteria that individuals must meet to become licensed insurance agents. Some states impose stricter requirements, such as mandatory exams and continuing education, while others have more lenient regulations.

successful completion of these regulatory requirements is necessary to operate as a licensed insurance agent. The variations in regulatory standards across states contribute to the differences in the number of insurance agents in each region.

Market Demand For Insurance Products

The market demand for insurance products is another significant factor influencing the number of insurance agents in the USA. Insurance products are essential for individuals and businesses to protect their assets and mitigate risks. The demand for various types of insurance, such as life, health, auto, and home insurance, fluctuates based on economic conditions, population demographics, and market trends.

For instance, regions with a higher population density and higher average income levels may have a greater demand for insurance products. Consequently, these regions are likely to have a higher number of insurance agents to cater to the needs of the local market.

Furthermore, changes in market trends, such as emerging technologies or shifts in consumer preferences, can impact the demand for specific insurance products. Insurance agents need to adapt to these market changes to ensure their businesses remain competitive.

The Role of Insurance Agents in The Industry

Insurance agents play a crucial role in the insurance industry, acting as intermediaries between insurance companies and individuals or businesses seeking insurance coverage. They are responsible for various tasks, including customer acquisition, policy sales, and service. Let’s delve deeper into these roles and understand the importance of insurance agents in the United States.

Customer Acquisition

One of the primary responsibilities of insurance agents is customer acquisition. They actively engage with potential clients to identify their insurance needs and offer suitable coverage options. Through various channels like referrals, networking, and marketing efforts, insurance agents strive to attract new customers to their agency.

Insurance agents also play a crucial role in the event of claims. They guide policyholders through the claims process, ensuring a smooth and efficient settlement. Their role is to advocate for their clients and help them receive the rightful compensation as per the terms of their insurance policies.

Challenges Faced By Insurance Agents

Being an insurance agent in the USA comes with its own set of challenges. From growing competition on online platforms to the need for constant adaptation to changing consumer preferences, insurance agents face numerous obstacles in their day-to-day operations. Let’s delve deeper into some of the challenges faced by insurance agents in the USA.

Competition From Online Insurance Platforms

With the rise of the digital age, insurance agents are facing tough competition from online insurance platforms. The convenience and accessibility provided by these platforms have led to a shift in consumer behavior, with more individuals opting to purchase insurance policies online. This has resulted in a significant dent in the market share of traditional insurance agents, requiring them to find innovative ways to stay competitive in the digital landscape.

Adapting To Changing Consumer Preferences

Consumer preferences in the insurance industry are constantly evolving. Insurance agents must continually adapt their sales and marketing strategies to align with these changing preferences. Whether it’s the preference for personalized insurance packages or the demand for streamlined digital services, agents need to stay abreast of these shifts to remain relevant in the market.

Training And Licensing Requirements For Insurance Agents

Insurance agents play a crucial role in helping individuals and businesses protect their assets. To become a licensed insurance agent in the USA, individuals must meet specific training and licensing requirements.

Educational Background

Individuals aspiring to become insurance agents need a high school diploma or equivalent as a minimum educational requirement. While a college degree is not mandatory, having a degree in business, finance, or a related field can be beneficial.

Continuing Education Obligations

Insurance agents are required to fulfill continuing education obligations to maintain their licenses. This involves completing a certain number of hours of continuing education courses regularly to stay up-to-date with industry trends, regulations, and best practices.

Technology’s Impact On The Insurance Agent Landscape

As technology continues to evolve rapidly, its impact on the insurance agent landscape has been profound. Insurance agents in the USA have been quick to adapt to digital advancements, embracing a range of tools and strategies that utilize technology to enhance their services and reach a wider audience. This shift has not only affected the way insurance agents operate but has also transformed customer interactions and the overall insurance industry.

Integration Of Digital Tools

The integration of digital tools has revolutionized the way insurance agents conduct business. With the aid of advanced customer relationship management (CRM) systems, agents can effectively manage and track customer interactions, streamline their sales process, and build stronger, long-lasting relationships with clients. Additionally, digital tools such as e-signature platforms have simplified the process of obtaining signatures for policy documents, making transactions more convenient for both agents and clients.

Use Of Data Analytics

The utilization of data analytics has empowered insurance agents to make informed decisions and provide more personalized services to their clients. By leveraging data insights, agents can better understand their clients’ needs and behaviors, leading to the development of tailored insurance solutions. Furthermore, data analytics enable agents to identify new market opportunities and optimize their marketing strategies for greater effectiveness.

Incentive Programs

Implementing effective incentive programs is crucial for attracting and retaining insurance agents. These programs not only motivate agents to perform at their best but also create a sense of loyalty toward the company. By offering rewards and bonuses, insurance agencies can incentivize agents to achieve their sales targets and go above and beyond for their clients. With a well-designed incentive program, agents are more likely to stay engaged, motivated, and committed to their roles.

Here are some strategies to consider when developing incentive programs for insurance agents:

- Set achievable goals: Establish clear and realistic targets that agents can strive for, ensuring they are challenging yet attainable. This will keep agents motivated without overwhelming them.

- Reward performance: Recognize and reward agents who consistently meet or exceed their goals. Consider offering monetary bonuses, commissions, or non-monetary incentives such as trips, gift cards, or public recognition.

- Offer tiered incentives: Create levels or tiers within the incentive program to give agents the opportunity to earn increasingly valuable rewards as they achieve higher levels of performance. This structure can help agents see a direct correlation between their efforts and the rewards they receive.

- Promote healthy competition: Foster a friendly and competitive environment by providing regular updates on individual and team progress. Display leaderboards or share performance statistics to encourage agents to push themselves and strive for excellence.

- Provide ongoing feedback: Regularly provide constructive feedback to help agents improve their performance and reach their goals. This feedback should be specific, actionable, and focused on areas where agents can enhance their skills and knowledge.

- Monitor and adjust: Continuously monitor the effectiveness of the incentive program and make necessary adjustments based on agent feedback and performance data. This ensures that the program remains relevant, motivating, and aligned with the changing needs of the agents and the company.

Professional Development Opportunities

Investing in the professional development of insurance agents is vital for attracting and retaining top talent. Providing ongoing learning and growth opportunities not only enhances agents’ skills and knowledge but also demonstrates the company’s commitment to their success. By offering professional development programs, insurance agencies can create a supportive and empowering environment that fosters agent retention.

Here are some strategies to consider when implementing professional development opportunities for insurance agents:

- Training programs: Develop comprehensive training programs that cover essential industry knowledge, sales techniques, product knowledge, and customer service skills. These programs can be in the form of virtual courses, workshops, mentorship programs, or on-the-job training.

- Continuing education: Encourage agents to pursue professional certifications, licenses, or additional qualifications through continuing education programs. Provide financial assistance or flexible scheduling options to support their educational endeavors.

- Coaching and mentoring: Assign experienced and successful agents as coaches or mentors to provide guidance, support, and advice to their peers. This allows for knowledge sharing, skill development, and personal growth within the team.

- Networking opportunities: Facilitate networking events, conferences, or industry seminars where agents can connect with other professionals in the insurance field. These events promote collaboration, relationship building, and exposure to new ideas and perspectives.

Future Outlook For Insurance Agents In The U.S.

The future outlook for insurance agents in the USA is heavily influenced by various trends in agent distribution channels and the evolution of agent-client relationships. These factors shape the way insurance agents operate and interact with their clients, paving the way for significant changes in the industry.

Trends In Agent Distribution Channels

The distribution channels through which insurance agents reach their clients are undergoing a transformation. Traditional methods, such as face-to-face interactions, are being complemented and sometimes even replaced by digital platforms. This shift is driven by the increasing use of technology in the insurance industry and the changing preferences of consumers.

Evolution Of Agent-client Relationships

The way insurance agents interact with their clients has also witnessed a significant evolution over the years. Traditionally, insurance agents were mainly seen as salespeople, focused on closing deals. However, in today’s customer-centric era, agents are increasingly adopting a consultative approach.

Insurance agents are now seen as trusted advisors, guiding clients through the complex world of insurance. They provide personalized recommendations, help clients understand their coverage options, and assist in making informed decisions. Building long-term relationships with clients has become a cornerstone of success for insurance agents.

Frequently Asked Questions For How Many Insurance Agents in The USA

How many insurance agents are there in america?

America has approximately 480,000 insurance agents.

Which state has the most insurance agents?

Texas has the most insurance agents in the United States.

How many life insurance agents are successful?

The success rate of life insurance agents varies, with no exact number available. However, being knowledgeable, and skilled, and building a strong client base can contribute to success in the industry.

Conclusion

The United States has over 400,000 insurance agents, with certain states having higher employment rates. The industry is constantly evolving, with new independent agencies continually emerging. Understanding the demographic and statistical data of insurance agents can provide valuable insights for those entering or already within the industry.